IUL vs Whole Life: Which Policy Is Right for You?

Indexed Universal Life (IUL) and Whole Life insurance are popular permanent life insurance coverage types that both provide lifelong death benefit coverage and cash value accumulation but differ significantly in flexibility, cost, and investment potential. Understanding these differences is crucial for selecting the policy that best fits your financial goals.

June 26, 2024

Table of Contents

Table of Contents

Key Takeaways

- Growth Potential: IUL offers higher potential returns linked to market performance, while Whole Life guarantees a steady but lower rate of return.

- Flexibility: IUL allows for adjustable premiums and death benefits, while Whole Life offers fixed terms.

- Risk Tolerance: IUL involves some market risk, while Whole Life is more conservative and predictable.

- Cost: Whole Life generally has higher premiums, while IUL premiums can be lower but may vary.

- Complexity: IUL requires more active management due to its connection to market indexes.

What is IUL Insurance?

Indexed Universal Life insurance (IUL) is a type of permanent life insurance policy that provides lifelong coverage and a cash value component, which grows based on the performance of a selected stock market index. IULs offer flexibility in premium payments, death benefits, and tax-deferred cash value growth. IUL policies combine life insurance protection with the potential for higher returns compared to traditional universal life policies while mitigating direct market risks.

What is Whole Life Insurance?

Whole Life Insurance is a type of permanent life insurance policy that provides lifelong coverage and includes a cash value component that grows at a guaranteed rate. Premiums are fixed, and the policy pays out a death benefit to your life insurance beneficiaries regardless of when the policyholder passes away. The life insurance cash value can also be borrowed against or withdrawn, offering a financial resource during the policyholder's lifetime.

Key Differences Between IUL & Whole Life

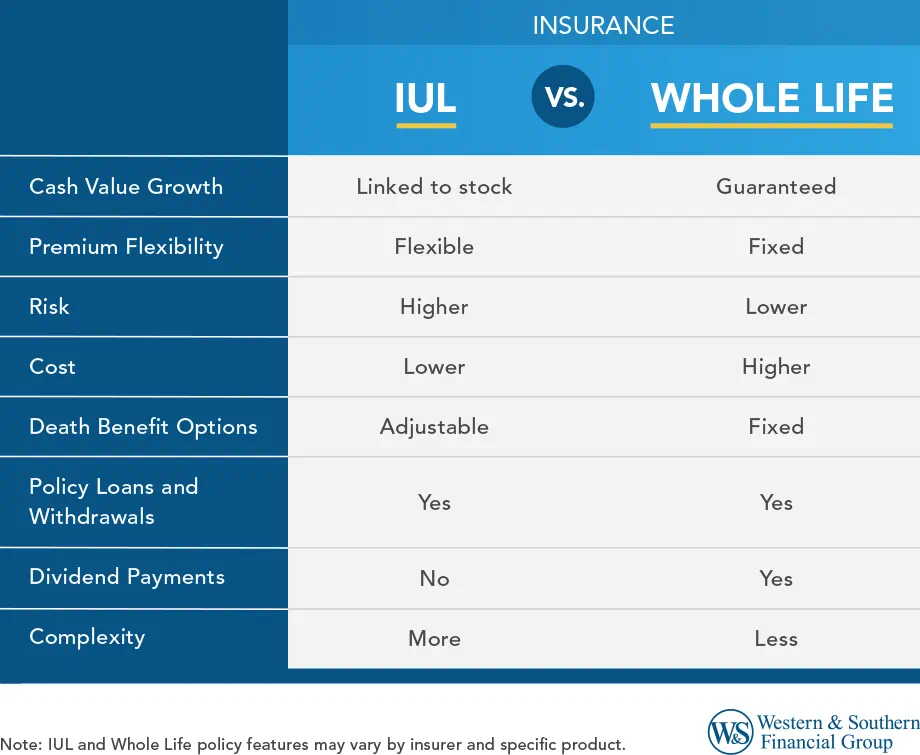

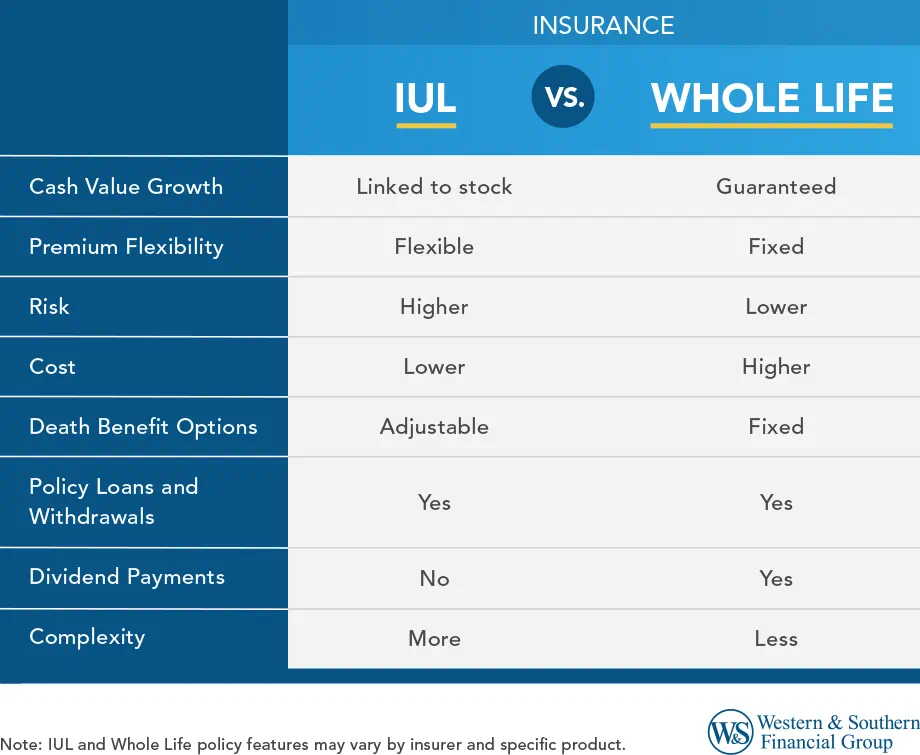

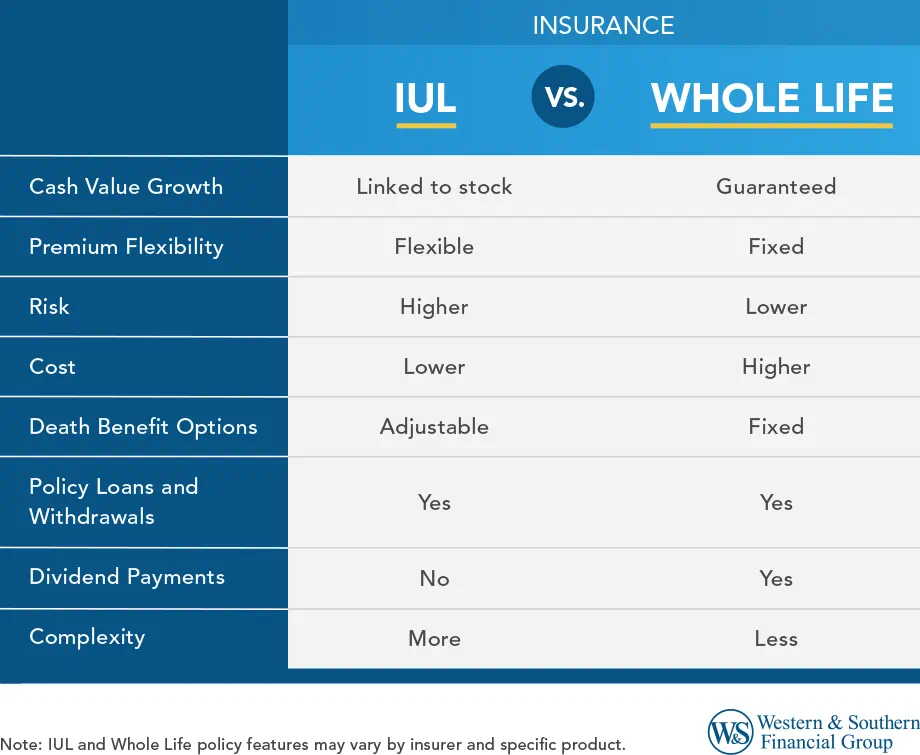

The key differences between an Indexed Universal Life insurance policy and a Whole Life insurance policy include:

- Cash Value Growth: IUL's cash value growth is linked to the performance of a stock market index, offering the potential for higher returns but with caps and floors to limit gains and losses. On the other hand, Whole Life insurance provides a guaranteed rate of return on the cash value, offering more stability but typically lower growth potential.

- Premium Flexibility: IUL policies offer premium payment flexibility, allowing policyholders to adjust their payments within certain limits based on their financial situation. Whole Life policies have fixed, consistent premiums that do not change over the policy's life.

- Risk: IUL carries more risk due to its exposure to market fluctuations, though it includes safeguards like floors to prevent negative returns. Whole Life insurance is less risky, with guaranteed cash value growth and death benefits, providing more predictable and stable financial planning.

- Cost: Whole Life insurance generally has higher premiums compared to IUL due to its guaranteed cash value growth and fixed benefits. IUL can have lower initial premiums but may vary over time depending on how the policy is managed.

- Death Benefit Options: IUL policies often allow for adjustable death benefits, meaning the policyholder can increase or decrease the death benefit amount over time, subject to underwriting and policy guidelines. Whole Life policies typically offer a fixed death benefit that does not change.

- Policy Loans and Withdrawals: Both IUL and Whole Life policies allow for loans and withdrawals against the cash value, but the terms and impact of the policy can differ. IUL policy loans might be influenced by the index performance, whereas Whole Life policy loans usually have more predictable terms.

- Dividend Payments: Whole Life policies, particularly those from mutual insurance companies, may pay dividends to policyholders, which can be used to increase the cash value, reduce premiums, or purchase additional insurance coverage. IUL policies do not pay dividends; instead, their growth is tied solely to the index performance.

- Complexity and Management: IUL policies are generally more complex and require more active management and understanding of market indices and caps/floors. Whole Life policies are more straightforward, with predictable growth and fixed premiums, requiring less management from the policyholder.

These differences affect each type of policy's suitability depending on your financial goals, risk tolerance, and the need for flexibility.

Ready for Clarity? Uncover the ideal life insurance solution for your financial future. Get a Free Life Insurance Quote

Pros & Cons of IUL Insurance

Advantages

- Potential for Higher Returns: Tied to market index performance, offering the potential for greater cash value growth than fixed-rate policies like Whole Life.

- Flexibility: Adjustable premiums and death benefits allow for customization to meet your changing financial needs.

- Access to Cash Value: Can access cash value through loans or withdrawals, providing financial flexibility.

- Downside Protection: Most policies have a guaranteed minimum interest rate to protect against significant losses in the market. 1

- Tax-Deferred Growth: Cash value growth is on a tax-deferred basis, meaning you don't pay taxes on gains until withdrawn.

- No Impact on Social Security Benefits: Unlike some retirement accounts, IUL withdrawals don't affect Social Security benefits.

Disadvantages

- Market Volatility: Returns are tied to market performance, meaning the cash value can fluctuate and may not grow as expected.

- Capped Returns: Most policies cap the maximum market return you can earn, limiting potential gains in a strong market.

- Complexity: More complex than other types of life insurance, requiring careful consideration and professional guidance.

- Potential for Lower Returns: In a poor market, the returns may be lower than traditional fixed-rate policies.

- Higher Fees: IUL policies typically come with higher fees than other life insurance types, which can reduce your returns.

- Requires Active Management: You may need to monitor your policy closely and adjust premiums or death benefits to ensure it performs as expected.

Pros & Cons of Whole Life Insurance

Advantages of Whole Life

- Guaranteed Death Benefit: Provides a guaranteed life insurance benefit payout to your beneficiaries upon your death, regardless of when it occurs.

- Guaranteed Cash Value Growth: Cash value accumulates at a fixed rate, providing a predictable and stable return.

- Fixed Premiums: Premiums remain the same throughout the policy's life, offering ease of predictability and budgeting.

- Potential for Dividends: Participating policies may pay dividends, which can be used to reduce premiums, increase cash value, or purchase additional coverage.

- Tax-Deferred Growth: Cash value growth is on a tax-advantaged basis, meaning you don't pay taxes on gains until withdrawn.

- No Impact on Social Security Benefits: Unlike some retirement accounts, Whole Life withdrawals don't affect Social Security benefits.

- Policy Loan Option: You can borrow against your cash value, providing access to funds in an emergency.

Disadvantages

- Premium Costs: Premiums are generally higher than other types of life insurance, making it a higher-cost option.

- Lower Potential Returns: Cash value growth is often lower than other investment options, limiting potential wealth accumulation.

- Less Flexibility: Premiums and death benefits are fixed, offering less flexibility than IUL policies.

- Surrender Charges: If you cancel the policy early, you may incur surrender charges, which can significantly reduce your cash value.

- Complexity: While simpler than IUL, Whole Life can still be complex, and it's important to understand the terms and conditions before purchasing.

- Slow Cash Value Growth: The cash value can take several years to build up significantly.

- Limited Investment Options: Your cash value is invested in the insurance company's general account, limiting your investment choices.

Which Policy Is Right for You?

Choosing between IUL and Whole Life insurance requires careful consideration of your financial goals, risk tolerance, and individual needs. Here are some key questions to ask yourself:

1. What Are Your Financial Goals?

- Wealth Accumulation: If you want to maximize your cash value growth potential, IUL may be more appealing due to its higher return potential.

- Guaranteed Protection: Whole Life might be a better fit if you prioritize a guaranteed death benefit and stable cash value growth.

- Retirement Income: If you plan to use your life insurance policy as a source of retirement income, IUL's potential for higher returns could be beneficial.

2. What Is Your Risk Tolerance?

- Risk-Averse: Whole Life's guaranteed growth and fixed premiums might appeal more if you prefer predictability and stability.

- Risk-Tolerant: If you're comfortable with some market risk and willing to sacrifice stability for the chance of higher returns, IUL might be a better choice.

3. How Important Is Flexibility?

- Need for Flexibility: If you anticipate adjusting your premiums or death benefit in the future, IUL offers that flexibility.

- Prefer Predictability: Whole Life offers that stability if you value knowing exactly what your premiums and death benefit will be.

4. How Much Are You Willing to Pay?

- Cost-Conscious: Whole Life generally has higher initial premiums than IUL, making it a more expensive option upfront.

- Open to Higher Costs for Potential Growth: IUL's potential for higher returns may justify its potentially higher long-term costs.

5. How Involved Do You Want to Be?

- Hands-Off Approach: Whole Life requires little to no ongoing management, making it a simpler option.

- Active Management: IUL requires more active monitoring and potential adjustments to premiums or death benefits to ensure optimal performance.

Conclusion

Choosing between IUL and Whole Life insurance is an important decision that requires thorough consideration of your financial goals and risk tolerance. By understanding each policy's key differences, benefits, and drawbacks, you can make an informed selection that provides the best protection for your future.

Contact a qualified life insurance agent to explore your options and find the ideal policy for you. They can help in assessing your needs and suggest the most appropriate policy for your specific circumstances.

Talk to an expert. Get personalized guidance on IUL vs Whole Life Insurance. Get a Free Life Insurance Quote

Footnotes

- The client can lose money with the product, just not due to declines in the indexes. The downside protection only extends to market losses. Insurance costs and charges will reduce account value, possibly resulting in a lapse if premiums and returns are insufficient. Avoid being overly promissory by specifying the protection that is offered.

- Withdrawals may be subject to charges, withdrawals of taxable amounts are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty.

- Interest is charged on loans; they may generate an income tax liability, reduce the Account Value and the Death Benefit, and may cause the policy to lapse.

Help Secure Your Legacy

Choose between IUL and Whole Life with confidence.

Related Life Insurance Articles

Whole Life Insurance vs. Universal Life Insurance: What's the Difference?

Life Insurance With Living Benefits

Explore the Top 8 Benefits of Whole Life Insurance

Pros & Cons of Life Insurance for Children

Understanding the Cash Surrender Value of Life Insurance

Is Cash Value Life Insurance Taxable?

What Is Credit Life Insurance?

What Is Graded Life Insurance?

What Is a Life Insurance Annuity?

Understanding Simplified Issue Life Insurance

IMPORTANT DISCLOSURES

Information provided is general and educational in nature, and all products or services discussed may not be provided by Western & Southern Financial Group or its member companies (“the Company”). The information is not intended to be, and should not be construed as, legal or tax advice. The Company does not provide legal or tax advice. Laws of a specific state or laws relevant to a particular situation may affect the applicability, accuracy, or completeness of this information. Federal and state laws and regulations are complex and are subject to change. The Company makes no warranties with regard to the information or results obtained by its use. The Company disclaims any liability arising out of your use of, or reliance on, the information. Consult an attorney or tax advisor regarding your specific legal or tax situation.

Contact Us

Monday - Friday | 8 a.m. - 6 p.m. ET

Saturday | Closed

Sunday | Closed

Holidays | Closed

- Whole Life Insurance

- Universal Life Insurance

- Term Life Insurance

- Life Insurance Calculator

- Annuities

- Individual Retirement Accounts

- Retirement Plans

- Retirement Calculator

- 401(k) Calculator

- Retirement Withdrawal Calculator

- Mutual Funds

- Investment Advisory

- 529 Plan

- Annuities

- College Savings Calculator

- About

- Financial Strength

- Careers

- Newsroom

- Corporate Responsibility

- Family of Companies

A.M. Best Company 1

Very Strong

Standard & Poor's 2

Very Strong

out of 100

Comdex Ranking 5

A.M. Best Company 1

Very Strong

Standard & Poor's 2

Very Strong

out of 100

Comdex Ranking 5

- Privacy Request

- Privacy Policy

- Accessibility Statement

- Terms & Conditions

400 Broadway Cincinnati, OH 45202

877-367-9734

© 2017-2024 Western & Southern Financial Group, Inc.

Western & Southern is the marketing name for a group of diversified financial services businesses composed of Western & Southern Financial Group and its seven life insurance subsidiaries. Life insurance and annuity products may be issued by The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Integrity Life Insurance Company, The Lafayette Life Insurance Company, National Integrity Life Insurance Company or Gerber Life Insurance Company. Products and services referenced in this website are provided through multiple companies. Each company has financial responsibility only for its own products and services, and is not responsible for the products and services provided by the other companies. Not all products and services are available in all states. All companies are members of Western & Southern Financial Group and are located in Cincinnati, OH with the exception of National Integrity and Gerber Life, which are located in White Plains, NY.

This site is intended to provide a general overview of our products and services. Please review the details of each product with your financial representative to determine which options may best fit your needs.

Western & Southern Financial Group does not provide tax or legal advice. Please contact your tax or legal advisor regarding your situation. The information provided is for educational purposes only.

1 Superior ability to meet ongoing insurance obligations (second highest of 13 ratings; rating held since June 2009 for six out of seven of Western & Southern Financial Group’s life insurance subsidiaries, rating held since February 2024 for Gerber Life). Gerber Life is not rated by other rating agencies.

2 Very strong financial security characteristics (fourth highest of 21 ratings; rating held since August 2018)

3 Very strong capacity to meet policyholder and contract obligations on a timely basis (third highest of 21 ratings; rating held since June 2009)

4 Excellent financial security (fourth highest of 21 ratings; rating held since February 2009)

5 The Comdex Ranking is a composite of all the ratings a company has received from the major rating agencies. It ranks insurers on a scale of 1 to 100 (where 1 is the lowest) in an effort to reduce confusion over ratings because each rating agency uses a different scale.

Financial strength ratings apply to the individual member insurance companies affiliated with Western & Southern. Gerber Life is rated only by A.M. Best. The Lafayette Life Insurance Company is not rated by Moody’s.

This may contain information obtained from third-parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third-party content in any form is prohibited except with the prior written permission of the related third-party. Third-party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD-PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD-PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice. Ratings are subject to change from time to time. The ratings shown here are correct as of February 20, 2024.

Gerber Life Insurance is a trademark. Used under license from Société des Produits Nestlé S.A. and Gerber Products Company.

![]()